DISCLAIMER / WARNING: Use this information at your own risk. The writer is not responsible in any manner for any loss readers may have in the market. This article is meant to be educational information only. Reading this article absolves the writer of any and all legal actions by direct or indirect parties. The writer is not a professional trader or financial advisor.

Summary

I have been trading and investing in stocks on and off for 42 years. I started trading when I was 21 using a broker because back then you had to use a broker. I never made a lot of money using a broker due to the high commissions rates charged by brokers back in those days. I am just an average Joe trying to make a living and my education and job became my main focus. I did not have the time or money to spend paying attention to the stock market. I invested in some mutual funds. They did ok, better than a bank, but the returns were not what I expected. I never made or lost a lot of money investing in mutual funds. Many mutual funds can be good investments over the long term if you have 20 or 30 years to wait.

In 1996 I found out that you could trade on line and since I had my own business now I could pay attention to the stock market sitting right in my office. I had some money saved by this time and it was just sitting in the bank. I started on line trading in 1996 and by 1999 I made more money trading stocks than what I did in my occupation. This was the Tech. bull market or Internet bull during these years. I made so much money it was incredible. If I told you I sometimes made $20,000 in a month you would not believe it. I increased my net worth by over 100% in two years. I was sold on using on line trading.

I also know many people who have lost a lot of money in the stock market including my own Mother when she used a broker. These people have sworn off the stock market as an evil system that just steals your money. I contend they have not spent the necessary time doing the required research. People who owned AIG, GM, and other so called blue chip companies lost their butt. I believe no investment is 100% safe. To make money it is necessary to take an educated risk. If you have money in the market then you need to watch it every day. If you do not one day you will wake up and your money will greatly depleted.

Yes, I have also lost money in the market. It is impossible to pick only stocks that go up all the time. Due to my diligent study of the stock market I have managed to make more than I have lost. It is equally important to know when to get out of a stock as well as what price to buy at. Take Citigroup Bank or C for example, three years ago it was at $45 per share and today it is $4.00. I too have sat mesmerized watching the market and my stock go down and down without making a move. All the time thinking this will stop going down soon. By the time you realize it will not stop going down it is too late to pull the plug and you have a huge loss. An on line trade only costs $8.00 to $10.00 so why wait and loose more money, sell that dog. You can sell and buy it back if the stock is any good. Looking again at Citigroup is it a buy now? Will it stay flat another 2 years? Would you buy it now?

Sometimes you get lucky and hit a big mover because you are watching the stock market. One such case was DNDN or Dendreon Corporation, a drug stock I purchased at around $6.00 and in 3 days I made $30,000. I purchased this on the news of a new drug waiting approval. The down side according to the chart was $2.00 per share if the drug was not approved. If approved I guessed the upside target price to be about $12 per share I thought this was a somewhat safe bet. It was approved and the stock shot up to $20 so I sold it. DNDN has since gone to $40.00 per share. If you do not believe it go to www.bigcharts.com and look at a 3 year chart. One can see what happen to DNDN in April of 2009 and where it is now. How else can you make that much cash in a few days? This was an educated gamble.

Over the years I have developed a simple system to use for investing in the stock market. I am now retired at 63 and trade the market every day. In this economy you need all the income you can get. Property values have dropped and are not going up any time soon. I cannot even sell my property without a huge loss of money that I need for retirement. The stock market is the only place to try and make money now in the short term.

There are many styles or types of trading as well as investments that can be done. I use the following two methods to make money in the market, momentum trading, and high yield dividend investments. In a bullish market 70% of my trades have made me money using my momentum trading system. For non bullish market or bear markets I just use my dividend stock picks to make money. I have set up two trading accounts one for dividend stocks which I buy and hold for the most part and one for trading momentum stocks as may be necessary.

Dividend Investments

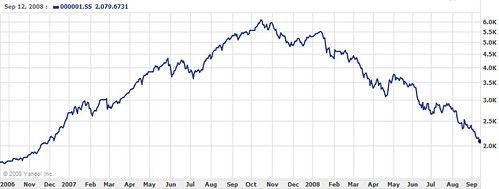

Most of these investments have little to no upside per say but provide a steady income. If you are lucky enough to purchase on the low side or when the market is down then you have an added bonus of some upside growth. Take a look at PHK on the www.bigchatrs.com on a 3 year chart. This could have been purchased at $4.00 per share in the 2008 and 2009 dip; it is now at $13.00. The dip mirrored the drop in the Dow Jones average. A gain of over 200% would have been made along with a 10% dividend per year.

Before buying I always check big charts and clear station (www.clearstation.com ) to determine the trend, the year high and low, the dividend rate, the 3 year low and high, and the long term history over a 5 to 10 year time period.

It is wise to use dividend stocks when you cannot watch the market every day. I look for ones that have at least a 5 year to 10 year track record. I also like those that pay out monthly. Some investments in this area are: PHT, ASP, EOS, PVX, and PHK to name a few. These are really income funds, and trusts which trade like normal stocks. There are many investments to choose from similar to these. I am not recommending any of these but mention them as a reference as many people are not aware of these high yield investments. The five I have listed above pay over 9% per year. If you look at 5 and 10 year charts you can see how stable these have been over the years and how long they have paid dividends. Of course a long history does not mean they are totally safe.

There are many stocks that pay dividends and utility stocks are also a good. Electric companies and telephone companies are cash generating machines. If you can buy these on the dip or low side during a market drop these can be very safe investments. One of my favorite is Progress Energy, symbol PGN. Even if the whole market drops PGN seems to hold up fairly well compared to other Blue Chip stocks.

One final point is if the market is dropping in general for some major reason such as the housing bubble or a 9/11 type attack then you should sell all stocks and buy them back near the bottom. Use past stock history as a guide to determine the bottom target price. I will usually sell if a 6% drop happens due to some event affecting the market. You can buy these again but not all at once. Buy shares over a long time period to average the price.

Momentum Trading

These stocks can be held for one day or one month or longer. As long as it is going up you can keep it or sell if you want to take your money. I always sell if there is a 6% drop, take your profit, and see what is going on. You can always buy it back. You must know your downside risk in dollars and your upside before buying. You must also know at what price to sell the stock. Make some money and get out is my theory.

If you can make a $500 average per day then based on 20 trading days per month that is $10,000 a month. This is hard to do, depending on the amount of money you are investing, but even if you only have a 50% record for picking the correct stock it is still $5,000 for the month. Doing this kind of trading is a full time job. You will spend 5 to 8 hours a day researching stocks and doing the actual trades.

Never buy a stock because it is a so called blue chip stock. Look what happen to GM. All stocks go up and down. Always remember the stock goes down much faster than it can go up. This is due to the SHORT FACTOR. I will not get into shorts as short trading is betting the stock goes down. Shorting should only be done by a very experience trader. I never do short trading as it is too risky for me but some of you may like the risk, as the rewards can also be big.

The momentum of stocks comes and goes but two stocks that have been around a while are BIDU and AAPL. Upon writing this article SLV, a silver trust was very hot and had a RS of 89 and a 100% buy for short, medium, and long term indicators on trading day (www.tradingday.com ). In addition gold stocks have been zooming up.

Selection of a momentum stocks is very tricky. I mainly use www.clearstation.com and www.tradingday.com to make my selection. I look for a RS factor or relative strength of 80 or more, which can be found on clear station. The stock should have a nice upward trend above the 50 day moving average. You can read on clear station how to use their charts.

Next I go to www.tradingday.com and enter the stock symbol in the Technical Buy / Sell signals. This shows short term indicators, medium term indicators, and long term indicators. I look for a short term indicator of 80% to 100% and medium and long term indictors of 100%.

So if I have a clear positive trend line up and a RS of 80 and an 80% short term indicator and 100% medium and long term, then I buy. But first I check on www.bigcharts.com to see where this stock has been over the last 3 years. This may or may not be important unless the stock has been up higher over the last three years. This may give you an idea of where this stock could go too. I read the news, history, profile, and profitability of the company.

This has been another tough year up until now for trading stocks. So far I have a 12% gain in my net worth using momentum trading. Not bad as it beats a bank but it could be better. Maybe I will get lucky making an educated gamble.

REMEMBER THAT BAD NEWS FOR THE ECOMONY OR TO THE COUNTRY (9/11 ATTACK) CAN CAUSE THE MARKET TO DROP VERY QUICKLY DUE TO A MASS SELL OFF DUE MOSTLY TO SHORTS.

Practice Trading Stocks

If you have no experience in trading stocks then start reading books about them such as those written by Jim Cramer who is on TV every night with his Mad Money show. Watch his show and also Fast Money on CNBC.

Before trading with real money go to www.updown.com and you can practice realistic trading on line without taking any risk with your money. These are dummy accounts using play money. I suggest doing this for about 3 to 6 months to gain a feel of how the market works as well as those stocks you select. It is suggested to make up a watch list of those stocks you have picked and play them on updown.com. When you feel comfortable you can slowly move into real trading.

I used updown.com this week to test some of my momentum picks and made a 9.3% profit on paper. Updown.com is a great tool to test your ideas and stock picks.

Stock Trading Tools

www.bigcharts.com This is used to check the chart of each stock at different time periods and the company news as well as if the company is profitable. You can also check the dividend amount and if it is paid monthly or quarterly.

www.clearstation.com This is used to check the 13 day EMA and 50 day moving average and the trend as well as the RS or relative strength of a stock. This is also a good place to pick up some ideas on what stocks to buy.

www.tradingday.com Trading day has news and you can find all kinds of information as well as check the technical BUY and SELL signals for a stock. For momentum trading you want an 80% to 100% buy signal for short term, 100% for medium and long term. Reading the news here I find most of my picks.

You will need a level 2 trading screen or a stock program that shows the actual selling price of each stock you buy or sell during the day. This the most important tool to use when buying or selling a stock. You need to know the minute by minute price to make the best possible trade. You can track the stock all day long and see the trading volume which important to watch. You can make a watch list of your favorite picks. Most on line broker companies provide this service fee of charge when using their trading platform.

Read IBD or Investor's Business Daily which is the leading paper for those interested in the market. One can find many good tips and stock picks reading this paper. Another good source is the Wall Street Journal.

One needs to remember that buying any type of stocks is a risk. It is very easy to lose part or all of your investment if one is not careful. If you decide to trade stocks and invest in the market it is wise to spend the necessary time to learn as much as possible. You are responsible for your own investments. Is the stock market an educated gamble or investment? I think it is both based on my experience.

penny stock promoters in new yorkI have a friend who put herself on a news fast at the beginning of this year. She did this because she was sinking into despair over the current state of affairs and our future as a species. She realized that part of her situation ...

Some Good <b>News</b> Weekend Meditation | The KitchnNews Writer. Pema Levy. Video Editor. Michael Lester. Polling Fellow. Tom Kludt. Video Fellow. Clayton Ashley. Publishing Fellow. Christopher O'Driscoll. Research Interns. Casey Michel. Publishing Intern. Taylor J Arluck ...

Republican Senate Nominee: Victims Of 'Legitimate Rape' Don't Get <b>...</b>Encouraging earnings results coupled with consumer confidence data and leading indicators drove the markets higher on Friday.

Stock Market <b>News</b> for August 20, 2012 - Zacks.com